Cash flow isn’t just another financial metric—it’s the fuel that keeps your business alive. Without the right strategy, even profitable companies can struggle to stay afloat. These five cash management methods will help you sustain operations, weather uncertainty, and unlock growth opportunities.

Entrepreneurs believe that profit is what matters most in a new enterprise. But profit is secondary. Cash flow matters most.

– Peter Drucker

Working Capital and the Cash Cycle

Cash management is inescapably tied to working capital. Working capital is the amount of cash you have tied up in your Cash Cycle, or Cash Conversion Cycle.

The Cash Conversion Cycle measures how long a company takes to turn inventory purchases into cash from sales. It consists of three key components:

Accounts Payable – Time taken to pay suppliers

Inventory – Time stock remains before selling

Accounts Receivable – Time taken to collect payment from customers

Smart business leaders manage each component strategically to stay competitive and reduce reliance on external funding.

An Example

Consider a business owner, Sarah, struggling to pay bills, forced into costly invoice triage (deciding what to pay) each week. To escape the cash shortage, they turn to working capital management as a solution.

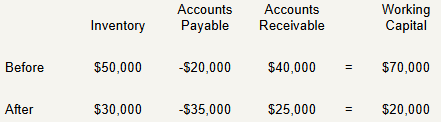

To begin, Sarah has $50,000 of inventory, $20,000 of accounts payable, and $40,000 of accounts receivable, totalling $70,000 tied up in their cash cycle.

Sarah discovers excessive inventory—some products have a year’s supply, others several months—locking up cash that could be put to better use. While low inventory risks stock shortages, excessive stocking drains resources. Just-In-Time (JIT) inventory management helps minimize holdings, and some items can be drop-shipped directly to customers. After optimizing inventory, Sarah reduces stock from $50,000 to $30,000, freeing up cash while lowering storage costs, spoilage, and stock count time.

She negotiates extended payment terms, securing 45–60 days from some vendors, reducing upfront cash outflows. This increases accounts payable from $20,000 to $35,000, allowing the business to sell some inventory before even paying for it—significantly improving cash flow.

Sarah renegotiates customer payment terms, securing faster payments, deposits, and prepayments for select clients. This reduces outstanding accounts receivable from $40,000 to $25,000, again strengthening cash flow.

Sarah’s efforts boost the business’s cash balance by $50,000—without loans, investments, or price increases. By optimizing inventory, negotiating vendor terms, and accelerating customer payments, she reduces cash tied up in the cycle from $70,000 to $20,000, freeing up needed funds.

Some businesses require significant working capital, investing heavily in inventory and receivables with limited vendor flexibility. These working capital-intensive industries—like manufacturing, distribution, construction, and retail—need substantial upfront funds to sustain operations.

Cash-generating businesses, on the other hand, operate with minimal working capital, benefiting from delayed supplier payments and fast customer receipts—often before delivering goods or services. With little to no inventory, industries like subscription services, software, consulting, and online marketplaces enjoy upfront collections and low operational costs.

No matter the industry, business owners can strategically optimize working capital to maximize efficiency and financial stability—working within the unique constraints of their business model.

The 5 Strategies

Working capital management encompasses three of the five strategies.

- Optimize Payment Terms

Negotiate extended payment terms with suppliers to improve cash flow. Longer due dates allow vendors to help fund your operations while minimizing immediate cash outflows. - Monitor Receivables Closely

Speed up customer payments by optimizing terms, requiring deposits, and enforcing timely collections. Staying on top of overdue balances strengthens cash flow and reduces financial strain. - Optimize Inventory Levels

Maintain only the minimum inventory necessary to meet customer demand. Overstocking ties up cash, while a lean inventory strategy—such as Just-In-Time (JIT) management—keeps working capital free for other needs. - Control Expenses

Regular expense reviews help identify unnecessary costs. Trend analysis can expose rising expenses, while a “Do I need this?” mindset helps eliminate wasteful spending, boosting profitability and cash flow. - Use a Line of Credit

A business credit line provides financial flexibility to cover short-term cash shortages. Used wisely, it can bridge gaps in cash flow and fund operations without tapping into reserves. Keeping interest costs low is key to responsible credit use.

Conclusion

Mastering cash flow isn’t just about survival—it’s the key to thriving. With the right strategies, you can enhance financial resilience, minimize stress, and build a foundation for lasting growth. These powerful tactics empower you to operate with confidence and stability, ensuring long-term success.

Tune in next week for a deep dive into negotiating better vendor terms.

Shane Bohlender, CPA, MBA, provides Fractional CFO leadership, outsourced bookkeeping and tax services at CPAsity.com