You can save money as an S Corp. It comes with some costs.

As an S Corp, you pay yourself a normal salary that is taxed like any other.

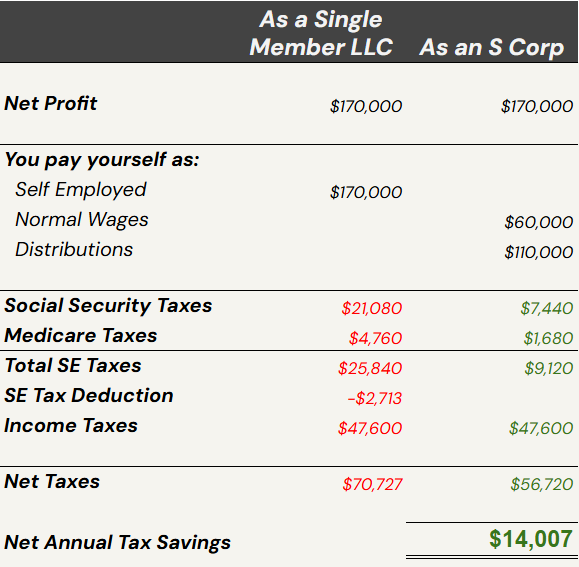

In addition to your salary, you pay yourself DISTRIBUTIONS, and these are NOT SUBJECT TO SE TAX. Because of this, you pay less taxes overall.

In the example to the right, a person making $170,000 saves $14,007 each year by converting to an S Corp.

How We Can Support You:

Helping you determine whether S Corp is right for you

Making the transition to S Corp

Filing S Corp tax returns

More Info

S Corporation Distributions: Shareholders of an S Corporation can receive distributions from the company’s profits, which are not subject to self-employment tax. However, these distributions are still taxed as income on the shareholders’ personal tax returns. The benefit comes from avoiding the self-employment tax that applies to sole proprietors or single-member LLCs.

Comparison with C Corporations: One advantage of S Corporations over C Corporations is the avoidance of “double taxation.” In a C Corporation, dividends paid to shareholders are taxed at both the corporate level (as corporate income) and at the individual level (as dividend income). S Corporations pass income through to shareholders, so it’s only taxed once on the individual’s tax return.

Comparison with Single-Member LLCs: A single-member LLC’s earnings are typically considered self-employment income and are subject to self-employment tax, which includes Social Security and Medicare taxes. In contrast, S Corporation shareholders don’t pay self-employment tax on distributions, though they must pay themselves a reasonable salary, which is subject to employment taxes.

Special Considerations

Reasonable Salary: The salary must be reasonable and may come under scrutiny. Industry standards, the responsibilities, the level of effort and other factors should be considered and documented.

Accountable Plans: Moving from SMLLC to S Corp, a filer loses the home office deduction. However, that can be effectively replicated using an Accountable Plan – a formal way of reimbursing the filer for business-related expenses, including home office.

Built In Gains Taxes: May apply to you if you transfer depreciated or below-market basis assets out of the business.

Shareholder Limitations: Limited to 100 U.S. Resident individuals.

Earnings and Profits (E&P): Accumulated unpaid earnings of a C Corp need to be tracked separately from the accumulated earnings as an S Corp as they are treated differently for tax purposes.

Corporate Responsibilities: Moving from SMLLC to S Corp is a step up in corporate documentation. Now you need to document minutes of meetings, resolutions for significant decisions, etc.

FAQs About Converting to S Corp

What is an S Corporation, and how is it different from other business structures?

An S Corporation is a tax designation that allows income, losses, deductions, and credits to pass through to shareholders for federal tax purposes. It’s not a business structure like an LLC or C Corporation but rather a tax status elected by eligible corporations or LLCs.

What are the eligibility requirements for S Corporation status?

To qualify, the business must be a domestic corporation, have no more than 100 shareholders, only one class of stock, and shareholders cannot be partnerships, corporations or nonresident aliens. Also, the company cannot be an ineligible corporation (i.e. certain financial institutions, insurance companies, and domestic international sales corporations).

More info at Internal Revenue Service.

How much does it cost to convert?

Converting to an S Corp requires filing Form 2553, which is relatively simple but does require the consent of all shareholders.

The ongoing maintenance cost of an S Corp are comparable to that of a C Corp. You might pay about $1,000 more per year in tax returns as a S Corp compared to a single member LLC.

Wat additional bookkeeping requirements arise from electing S Corp?

Electing S corporation (S corp) status introduces several additional bookkeeping requirements compared to other business structures. Here are some key aspects:

Payroll Management: If you’re an owner-employee, you must pay yourself a reasonable salary. This involves setting up payroll, withholding taxes, and filing quarterly payroll tax returns (Form 941) and annual reports (Form W-2 and W-3).

Separate Financial Records: S corps must maintain detailed records, including meeting minutes, bylaws, and shareholder agreements, alongside financial reports.

Tax Reporting: S corps file Form 1120-S for their income tax return and issue Schedule K-1s to shareholders, detailing their share of income, deductions, and credits.

Accounting Method: You may need to choose between cash and accrual accounting methods, depending on your business’s complexity and IRS requirements.

Shareholder Record-Keeping: Shareholders are responsible for reporting their share of the S corp’s income on their personal tax returns, requiring accurate bookkeeping.

Compliance with State Regulations: Additional state-specific requirements may apply, such as filing annual reports or maintaining certain records.

What are the tax advantages of an S Corporation?

S Corporations avoid double taxation, as profits are taxed at the shareholder level rather than the corporate level. This can result in significant tax savings over C Corporations.

S Corporation pay owners a distribution that is not taxable. This is a significant benefit over C Corporations where such payments are dividends and taxable income to the owner. This is also a benefit over single owner LLCs where all earnings of the company are taxed as self employment earnings of the owner.

How do I elect S Corporation status?

After forming your business as a corporation or LLC, you must file IRS Form 2553, “Election by a Small Business Corporation,” within the required timeframe.

What are the ongoing compliance requirements for an S Corporation?

S Corporations must adhere to strict operational guidelines, including holding annual meetings, maintaining corporate minutes, and filing specific tax forms.